Where Do Your Premium Dollars Go?

Discover the transparency behind your healthcare premiums and how we ensures that premium dollars are spent where it matters - on your health care.

Health insurance gives you timely access to doctors, prescriptions, and other services that help you and your family feel your best. But like many household expenditures, your healthcare premiums may increase even if your medical needs don’t. Your confidence in our organization means everything to us, which is why we are sharing where your premium dollars go.

We do everything possible to ensure our members' health and wellness are at the core of what we do. The cost of care can be a significant barrier to our members’ ability to access the providers and pharmaceuticals they need, which is why we work hard to optimize every premium dollar and keep costs as low as possible.

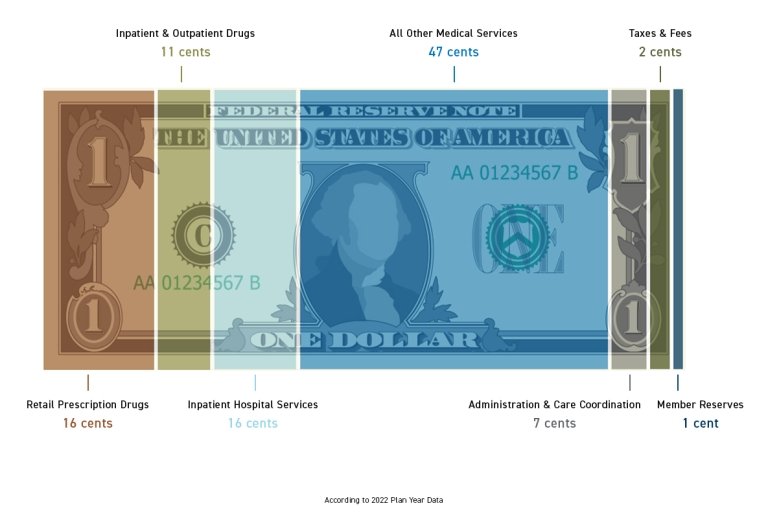

How are premium dollars spent?

At Blue Cross and Blue Shield of Vermont (Blue Cross Vermont), every health care dollar is stretched as far as possible. Nearly 90% of every premium dollar directly pays health care claims (members’ doctors and hospital bills), and the remainder is for taxes or fees and invested in IT, administration, and services to improve member health and wellness.

We hold ourselves to high standards when ensuring Vermonters’ premium dollars are spent where it matters - on their health care. We are a nonprofit health plan whose mission is to provide healthcare coverage that improves the health and wellness of our members. We have no shareholders—Vermonters are who we serve, every single day.

Let’s explore premium spending in more detail. The below numbers are averages across the health insurances plans at Blue Cross Vermont and not specific to certain business segments.

Medical cost breakdown

Medical costs account for approximately 90 cents of each premium dollar and include:

- Retail prescription drugs (16 cents): Medications you pick up at pharmacies and receive through online drug services

- Inpatient and outpatient drugs (11 cents): Medications you receive at a hospital

- Inpatient hospital services (16 cents): Hospital charges and services you receive while admitted

- All other medical services (47 cents): Office visits, mental health counseling, physical therapy, outpatient care, preventive care, labs, and other services

Administrative cost breakdown

We are careful to streamline our operations. A small portion of each premium dollar (approximately 10 cents) covers the costs of running our organization:

- Administration and care coordination (7 cents): Employee salaries, buildings that house operations, technology, and care coordination for chronic and complex conditions

- Taxes and fees (2 cents): State taxes and fees on premiums collected and Affordable Care Act fees paid to the Federal government

- Sustaining member reserves (1 cent): Money required to ensure we are able to pay claims no matter what

What happens with money that’s not used for medical and administrative costs?

We are required by law to sustain a member reserve fund. This fund enables us to continue to pay claims and operate when there is a catastrophic event, like a natural disaster or pandemic. It provides added security for meeting your medical needs even when the unexpected happens.

Helping you get the most out of your Health Plan

Helping your plan benefits go further is the very essence of what we do. These efforts start with affordable, high quality health plans and a careful scrutiny of costs. This way, we work hard to ensure that your premium dollars bring you as many valuable benefits as possible. We offer a range of options for individuals and families, making it easier to find one that meets your needs and budget. Learn how to choose a health insurance plan.

Additional offerings include:

- Personal health support services: Licensed clinicians help you navigate some of life’s most exciting and challenging health events. These include pregnancy, addiction, complex and chronic disease, and end-of-life care. Read more about additional health plan benefits you might not know you have.

- Be Well Vermont: Our enhanced wellness offering that includes assessments, health trackers, and online learning modules. Explore wellness programs that help you live your best life.

- Health savings accounts: Health spending and savings accounts offer tax advantages while enabling you to save for future care needs. Read everything you need to know about health savings accounts (HSAs).